Treasury undertakes an Investor Confidence Rating report from time to time.

This is a Cabinet-approval process for assessing agency investment performance and thus the level of confidence stakeholders should place on the ability of an agency to manage its assets and investments well. Cabinet had set the expectation that all investment-intensive agencies should achieve at least a “B” rating over time.

Why does Treasury have the ICR?

- To reinforce the main objective of the governments investment system which is to optimize value for New Zealanders and

- To provide an incentive mechanism that rewards good investment management and proactively addresses gaps.

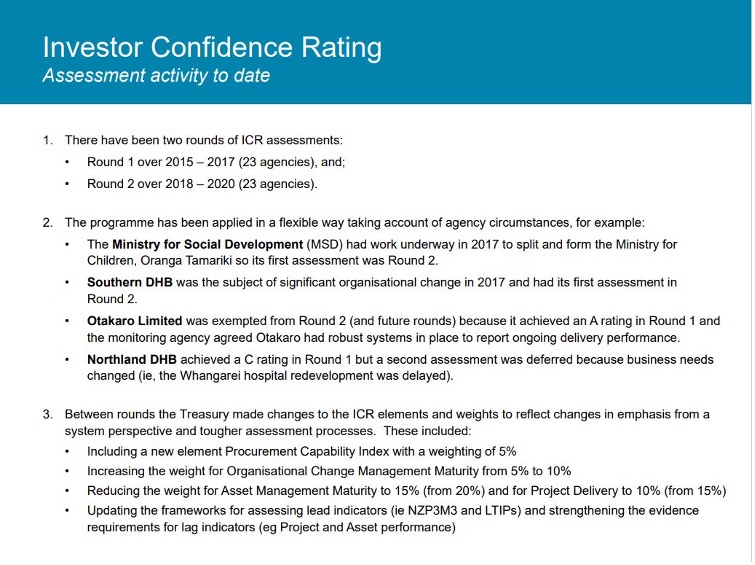

There have been two rounds of ICR assessments:

- Round 1 – 2015 to 2017

- Round 2 – 2018 to 2020

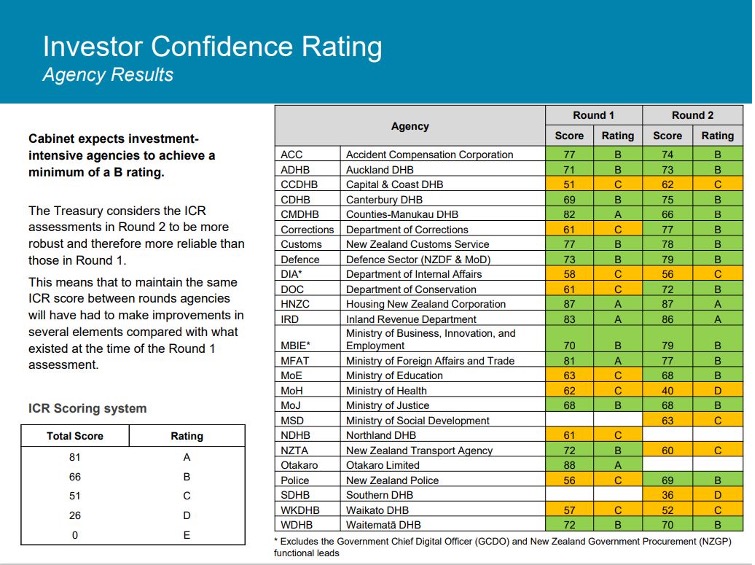

Below are the ICR ratings for the two periods covering 23 agencies.

In the report the Treasury noted that the ICR assessments in round 2 to be more robust and therefore more reliable than those in Round 1. This means that to maintain the same ICR score between rounds agencies will have had to make improvements in the several elements compared with what existed at the time of the Round 1 assessment.

A couple of points to note:

- Ministry of Health achieved a D rating and their rating dropped between assessments

- CDHB was the highest ranked of all the DHBs and showed an improvement between Round 1 and Round 2.

Read these extracts from the report and think that before the last executive was pressured out of office under instructions by the Ministry of Health because of their “financial mismanagement” the finances were assessed by an independent agency, treasury, and found to be the top performers in DHB’s in NZ. It is worth questioning how well the MOH is run, administratively and financially.

When the executive left, we were told by the Chair that the CDHB would be financially viable again. The next year they had a $177m deficit. I wonder what their ICR would be now?

Here’s the report:

Leave a Reply