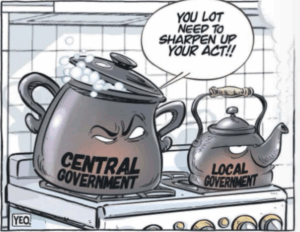

It saddens me when Local Government (LG) is hammered publicly by Central Government (CG). Over the Local Government NZ (LGNZ) conference held in Christchurch last week (and, again let me object to Christchurch City Council resigning from LGNZ that was a dumb, no stupid, decision which should be reviewed) NZ’ers were treated several times to Cabinet Ministers rubbishing LG.

In this article The tension between central and local government bubbles to the surface | The Spinoff the Minister of LG, in a stunning exercise in hypocrisy, said:

“People don’t have an appetite for nice-to-haves,” he says. “You weren’t elected to make easy decisions; you were elected to make difficult decisions. The best thing I can do is to help you on that journey.”

In another media article it was reported:

local government minister Simon Watts, speaking at a Taxpayers’ Union LGNZ protest, told those gathered he wanted rates capping “in place as fast as possible”.

In a video posted by the Taxpayers’ Union on social media, Watts said the government needed to intervene and make sure caps were in a sensible place, in order to bring costs down for ratepayers.

“This is your money, this is ratepayers’ money,” he said.

“In terms of timeline, we’re working at pace. I know everybody wants it to be done yesterday.

“My direction to my officials is crack on, I want this in place as fast as possible. We’re aiming to have that all decided … definitely before Christmas, if we can go faster we will.”

Watts said he was making sure to get the details right, so that when the policy comes into force, “as fast as possible it actually achieves that outcome.”

I’m fed up with Ministers of LG, generally with no LG experience, saying things like that. They trot out phrases like “nice-to-haves” and the media soak them up with no serious analysis about what they mean. Let’s talk about his government building our convention centre 3 times the size recommended by the architect who did the “bulk and location” exercise in the 100-day plan. Or talk about the sports centre which is 2 years late and massively over budget being constructed and managed by CG.

Watts, a Chartered Accountant, supports and Rates Cap and is taking a proposal on a rates cap to Cabinet. Many of our local candidates standing for CCC this year are supporting this idea.. My advice to the voters, these people are leading you astray. To say the rates will be “this” when I get to the Council table is just an outright misstatement. The reality is that over half of the Councillors present need to agree with this person, or their words are just hot air during an election campaign.

In this article Govt winds up council reform storm – Newsroom it was reported:

The Local Government NZ conference in Ōtautahi/Christchurch was formally launched on Wednesday with a video address, of less than two minutes, by Prime Minister Christopher Luxon. Councils need to get back to basics, he said, spending wisely and delivering value. What does that mean? “Prioritising pipes over vanity projects,” explained the prime minister, flanked by national flags. “It means roads over reports, and it means real outcomes.” When the address finished, conference MC Miriama Kamo started clapping loudly, joined somewhat unenthusiastically by a smattering of conference attendees. “I’m the only one clapping, I see,” Kamo quipped.

It demonstrates the loathing the PM feels toward LG by the fact he didn’t even turn up and was consequently received so badly by those present. When central government speaks to a partner in such condescending ways people should start asking the question of when does condescending behaviour apply to all?

There was considerable discussion by government speakers on “rates caps” which is merely an attempt by CG to distract NZ’ers from focusing on the government’s current mistakes in policy. I really liked this comment on RNZ:

When asked for his position on rate caps , Winston Peters responded by saying “every other party is interfering in local government” and that New Zealand First had never interfered in local government.

“It’s a case of doctor, heal thyself” he said, “we can’t be preaching to them when we haven’t got our own spending under control ourselves.”

Here’s what Gareth Hughes wrote in this article: Wellbeing is at the heart of what local govt does, law change or not | The Post

It’s frustrating that so much parliamentary time has been spent adding words and then deleting them, but the fact of the matter is you can take the word “wellbeing” out of legislation but you can’t take wellbeing out of local government. Collective wellbeing is at the heart of what our councils and local boards are there for.

The reality is if the wellbeings are once again removed from the act, councils will do wellbeing work anyway because this is at the heart of what it means to live in a community. Central government isn’t going to build parks, playgrounds or pools, and it is not going to drive local economic development. Only local governments can do that because they are closest to their citizens.

Local government is more than just roads, rates, rats and rubbish — it plays a key role in building local economies and is uniquely positioned to foster local resiliency and wellbeing in our communities. It’s in the parks we walk through, the water we drink, the pools we take our kids to, the buses we ride, and yes, even the rubbish and recycling we put out on the street.

There are many systemic challenges facing the local government sector that are crying out for leadership — from funding models to the number of councils.

The cost of returning GST from rates to local councils

Local government rates are effectively a collective group charge for a range of goods and services that councils provide to an area, rather than each individual person or household paying separately for those goods and services. But as councils are providing goods and services, rates are subject to GST (and rightfully so).

This rate of GST – an additional 15% of the value of the base local government rate collected – does not go to local councils but instead to central government, as with all GST.

Infometrics analysis suggests that the value of GST collected on local government rates in 2022 (the latest detailed data available) would be worth around $1.1b. To put this figure in context, that $1.1b in additional revenue in 2022 would have been worth 9.2% of total council operating income, or 8.6% of operating expenses.

Chart 2 in this article outlines the expected additional revenue for each local council across New Zealand if GST was returned to local government, based on the most recent figures available. It shows that additional revenue would range from $1.2m for Kaikōura (or $102k for outlier Chatham Islands) through to $317m for Auckland.

Leave a Reply