In the last few days of his term as CE of CDHB David Meates produced this financial statement. All the Minister of Health’s response was that his advice from the Ministry of Health and Treasury did not support David Meates’ arguments. His blind faith in the advice he is getting puts his judgement at a questionable place.

Here is David Meates’ comment on CDHB’s finances:

Why does Canterbury DHB have a deficit? There have been a large number of requests for clarity about Canterbury DHB’s deficit position in response to some poorly informed comments made in recent weeks.

For the sake of clarity, and to remove any ambiguity, I hope that the following summary will help all staff understand why we have a deficit.

The aftermath of the earthquakes and subsequent decisions from central agencies has continued to have a significant impact on our DHB. While our collective focus over this past decade has been on efficient and effective provision of services we have continued to grapple with a number of factors outside our control. These factors that contribute to the DHB deficit can be best summarised as follows:

1. Earthquake-related depreciation costs (>$35m per annum (pa))

2. Earthquake/insurance-related capital costs ($23m pa)

3. The decline in Canterbury’s funding share (>$60m pa)

4. Delays in the delivery of Hagley and other facility related inefficiencies as a result of the earthquakes (>$60m pa)

The combined total of these four drivers alone is $178 million per annum, and each year Hagley is delayed we have to pay for another year’s worth of outsourced/ outplaced surgery.

Capital charges are the funds we pay to the government – much like a tax on our assets. And when we invest in new facilities, we are liable to pay more capital charges.

Depreciation is a way of spreading the cost of replacing big assets, such as buildings or expensive equipment, over the life of that asset. Depreciation rates are based on the value and useful life of an asset. With the repair of damaged buildings post-quakes, we have had to invest significant money to be able to continue to use these facilities. This increases the value of the assets and therefore, the funds we pay the Crown. However, their life has not been extended and this results in a higher depreciation level than would be expected, which impacts our financial results. We pay $50m more each year in depreciation charges than a similar sized DHB, which directly impacts on the resources we have to allocate to services.

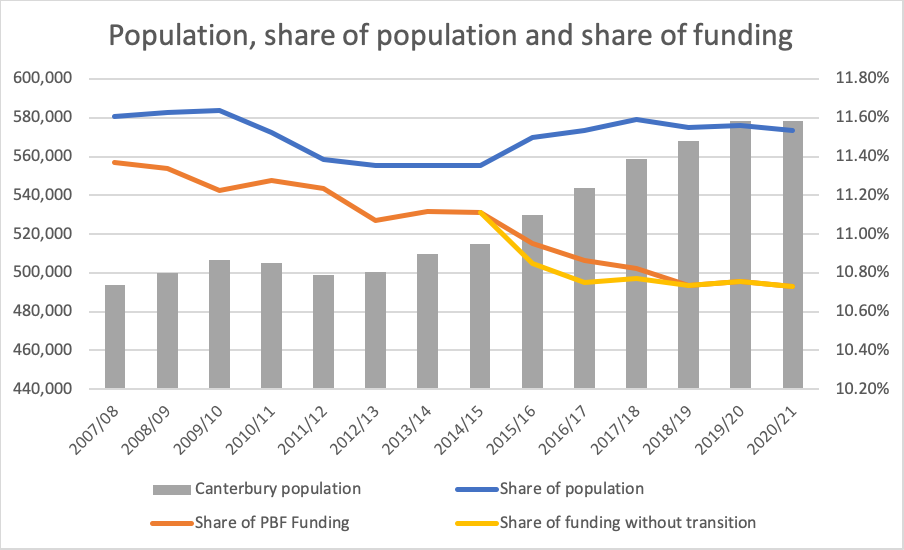

Recent Statistics NZ work verified that Canterbury’s population has grown at a higher rate than the New Zealand average (1.35% vs 1.26% annually) and growth has remained steady over the past three financial years. We have approximately 11.5% of the country’s population, but our share of population-based funding has declined markedly, particularly since 2014/15 (from 11.11% to 10.73%).

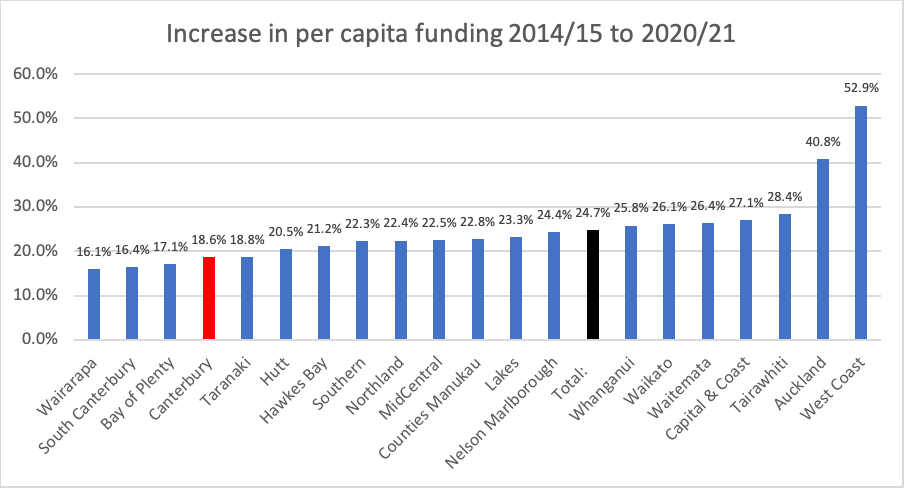

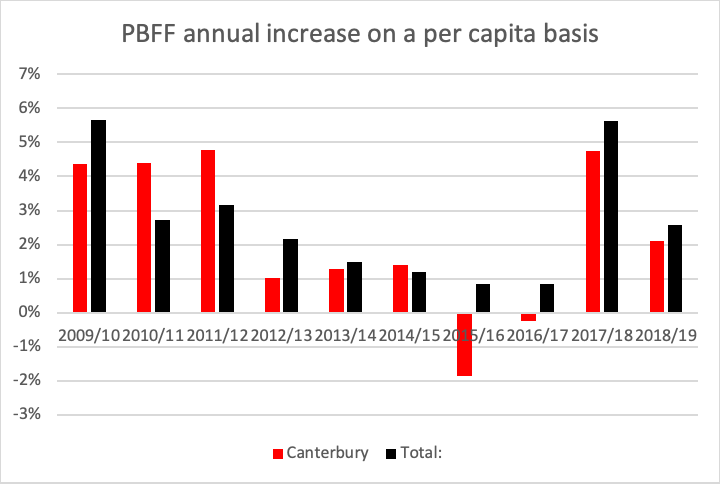

Our share of population-based funding has not matched funding increases of similar sized DHBs who have recently had significant drops in their populations according to recent Statistics NZ estimates. From 2014/15 to 20/21 our funding per capita of population increased by 18.6%. Over that same time period the average increase across large DHBs was 26.9% and the national average increase for all DHBs was 24.7%. If Canterbury continued to be funded at 2014/15 rates, it would have over $70m more revenue this year.

From 2014/15 to 20/21 our funding per capita of population increased by 18.6%. Over that same time period the average increase across large DHBs was 26.9% and the national average increase for all DHBs was 24.7%. If Canterbury continued to be funded at 2014/15 rates, it would have over $70m more revenue this year.

FACT: Every year Hagley has been delayed we have had to pay millions to outsource and outplace surgery in the private sector. Delays to Hagley & other facility-related inefficiencies cost us more than $60 million each year.

FACT: If Hagley, the Acute Services Building, had been delivered on time in 2018, we would be in a break even position now.

FACT: Canterbury’s lower funding share which declined sharply in 2014/15, impacts further than our base funding. It is applied to new funding and PHARMAC uses it for allocating additional funding for pharmaceuticals irrespective of the specific population need. This year alone the gap between our PHARMAC- forecasted pharmaceutical spend and the population based funding allocation is $14m.

FACT: Between 2012-2020 Canterbury DHB received $723,901,000 in equity (funding) from the Ministry of Health. However, during that same period Canterbury DHB paid back $700,985,000. Therefore, the net additional equity (cash/funding) injection from the Ministry of Health during that period was $22,916,000.

How do our financial controls rate?

As stewards of public assets, we are proud of our achievements in these areas.

The Treasury oversees a process to determine an organisation’s capability and maturity in managing investments and assets. The assessment draws on international best practice and encompasses nine elements to determine a score and rating.

Canterbury’s Investor Confidence Rating (ICR) is a three-yearly evidence-based assessment of our performance in managing investments and assets critical to the delivery of services.

Our latest assessment was a B, with the highest score across the DHBs in the tranche undertaken in 2019. We have been one of only a few DHBs that have improved our rating over the two assessments done to date, as each assessment is tougher than the last.

Our internal audit process works to a three-year cycle of reviews where our Board and Quality Audit Risk and Finance Committee determine the areas that they wish to be focused on. These audit reports are then provided back to the Board for their scrutiny.

We have received consistently good ratings on our robust financial controls. Financial controls include things like Delegations and Approval processes and policies, and we are subject to regular audits of these, from both internal and external auditors.

It’s worth noting that our deficit situation has absolutely nothing to do with our financial controls.

FACT: In recent years, four external reviews of our finances have concluded that when compared with other DHBs we are operationally efficient.

Canterbury DHB’s Statement of Service Performance, a key accountability document, proves that we have delivered to our population what we were supposed to, and our Statement of Service Performance has consistently received the highest possible rating from Audit NZ, proving that we do what we say we do.

Together we have created a system built on trust. Change happens at the speed of trust.

Haere ora, haere pai Go with wellness, go with care.

David Meates CEO Canterbury District Health Board

Leave a Reply