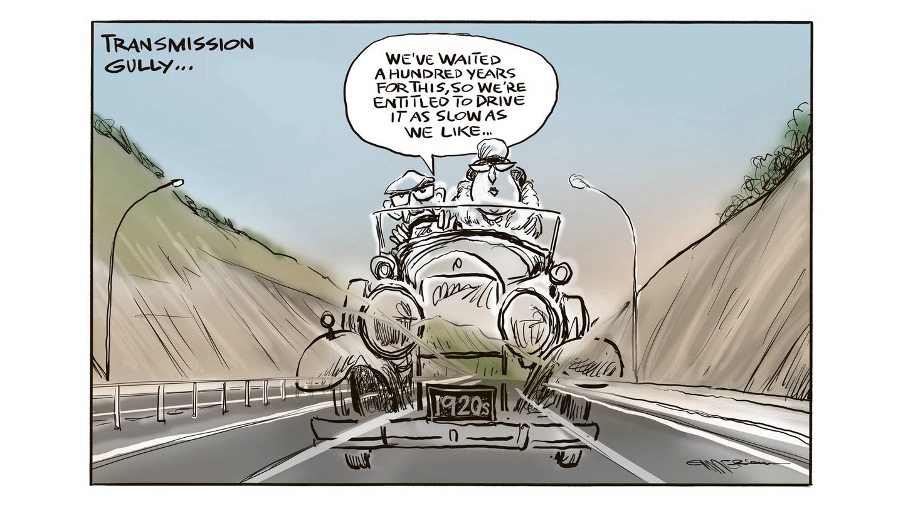

The benefit which derives to communities from public expenditure is seldom measured. Mostly because most journalists are financially illiterate. Bernard Hickey is a financial analyst who adds items together where seldom others venture. In the case of Transmission Gully, he has conducted some remarkable analysis in this article:

https://thespinoff.co.nz/business/01-04-2022/the-true-costs-and-benefits-of-transmission-gully.

Built at a cost to the public of at least $1.25b, Wellington’s four-lane Transmission Gully highway finally opened to motorists today, locking in place $7.8b worth of tax-free capital gains for land owners in the Kapiti Coast and Horowhenua District Council areas in the last five years of its construction.

It is the biggest example in Aotearoa-NZ’s history of the financial cost of a public infrastructure project being borne by the public at large, but the collective financial benefits accruing to landowners without those benefits being taxed. In effect, renters will at least $180m worth of GST and income tax for each of the next 25 years to build and run the motorway, while economic benefits worth billions have already accrued to land owners.

Transmission Gully was the main reason for land prices escalating on the Kapiti Coast and Horowhenua by $2b over the last three years. Renters and land owners will pay taxes of at least $1.25b over the next 25 years. In return, land owners have already banked the $2b in land price escalation benefits. Without paying a cent in taxes on these unearned capital gains.

The road will save motorists an average of 11 minutes for the trip between the CBD and the Kapiti Coast, and in theory reduce each driver’s petrol usage by even more because of more efficient engine performance at higher speeds and straighter roads. However, carbon emissions may be substantially more in net terms because the motorway is expected to encourage more people to drive the route because it will be faster and safer, and because fewer people are expected to use public transport.

Why aren’t the beneficiaries paying?

These unearned capital gains over the last three to five years are of course yet to be taxed, and then only partially and lightly through the 10 year brightline tax on rental property owners. Owner occupiers and landlords who hold on for enough years won’t have to pay tax.

However, in other countries with capital gains taxes, at least some of those gains are captured. Many cities also use the capital gains more directly to pay for the projects through special land value capture uplift rates. This tax would be imposed by a council on the landowner benefiting from the publicly funded infrastructure such as a road or railway to pay for that infrastructure. It is one of the ways the current Government wants to pay for the Auckland Light Rail line.

National opposes the use of value capture uplift rates and a capital gains tax, while Labour has ruled out a capital gains tax for the political lifetime of the current Prime Minister.

I have a sister living on the Kapiti Coast. I expect as soon as she has read this, she will assure me that she would be only too happy to pay extra tax to cover the substantial capital gains she has “earned” by being in the right place at the right time….

Leave a Reply