I received an interesting response to the article on banks in the last email. This week I thought I would print Cam Preston ‘s thoughts on the banking system as a whole. It does summarise the system really well.

I have been sent some a really useful series of articles on the bank’s behaviour over the last few years and I will supply links to them next week. I will say (to shut Geoff Butcher up) that of course I know banks are essential. However, my beef is that they were bailed out in 2007/8. They pocketed the loot and then played a major part in pumping up property prices in New Zealand and they made super-profits. Then much of these profits disappeared to Australia.

I believe that if the Government is putting support into the banking sector then we, as taxpayers in this country, should end up with partial ownership of these banks. In 2007/8 the banks were bailed out all over the world. When they recovered as a result of these bailouts Governments around the world were not able to share in any of the ups of the banks being in great financial nick.

Just in case you think it’s just NZ banks have a look at this Guardian article written this week.

Anyway, here are Cam’s thoughts on the banking system:

I read your comments on NZ banks with interest in the last newsletter. We in Christchurch are as well-equipped as any to understand the shortcomings of our financial services providers. Like insurance companies and banks. We often experienced a lack of good faith towards claimants, or customers, when times get tough, as well as and the lack of good regulation.

Like anyone I have been struggling to keep a track of all the information recently, here is my analysis of some important aspects of situation. We will have very interesting times ahead!

1. Stopping the car from stalling

The Reserve Bank of NZ (RBNZ) is the ‘prudential’ (to show care and forethought) regulator for the banking and insurance sector in New Zealand.

As witnessed by the collapse of insurance companies and slow pay out of claims following the earthquakes, we haven’t been very good at regulating our banks and insurance companies in NZ, who have – since deregulation in the 1980’s – seemingly prioritised their profits over their obligations to their customers.

This has generally manifested itself in a preference to pay out dividends to their shareholders and excessive remuneration to their senior managers. It appears that there is too often little regard and forethought for saving for uphill battles, or headwinds such as an earthquake, or a pandemic.

Because you are a car guy Garry, imagine that the Treasury and RBNZ is a driver, the economy is a car, the accelerator pedal is ‘monetary policy’ (RBNZ) and ‘fiscal policy’ (Treasury) which heavily influence the car’s speed (the velocity of money and rate of inflation rate).

Treasury and the RBNZ’s objectives are to keep the car moving steadily along at 50km/hr, not too fast, not too slow.

When the car starts climbing hills, the RBNZ and Treasury pushes further down on the accelerator pedal. When the car starts descending from the hills, they lay off the accelerator pedal.

The theory goes, over many hills and kms, the RBNZ and Treasury can maintain 50 km/hr by making these adjustments to the accelerator pedal.

A child sitting in the backseat of the car who was oblivious to the hills but saw the many changes to the accelerator pedal would probably conclude the accelerator pedal has no bearing on the speed of the car. After all, no matter what happened to the accelerator pedal the car’s speed never changed.

As outside observers, we know better. We know the driver was adjusting the accelerator pedal just enough to offset the ups and downs of the hills so that a constant speed was maintained. In terms of our analogy, monetary policy and fiscal policy was adjusted just enough to offset the ups and downs of the economy so that a stable inflation rate and a stable velocity of money (the speed with which money circulates within the economy) is maintained.

2. The Hill

Here are a couple of graphs that caught my attention recently to show you how steep the hill is that we have just hit:

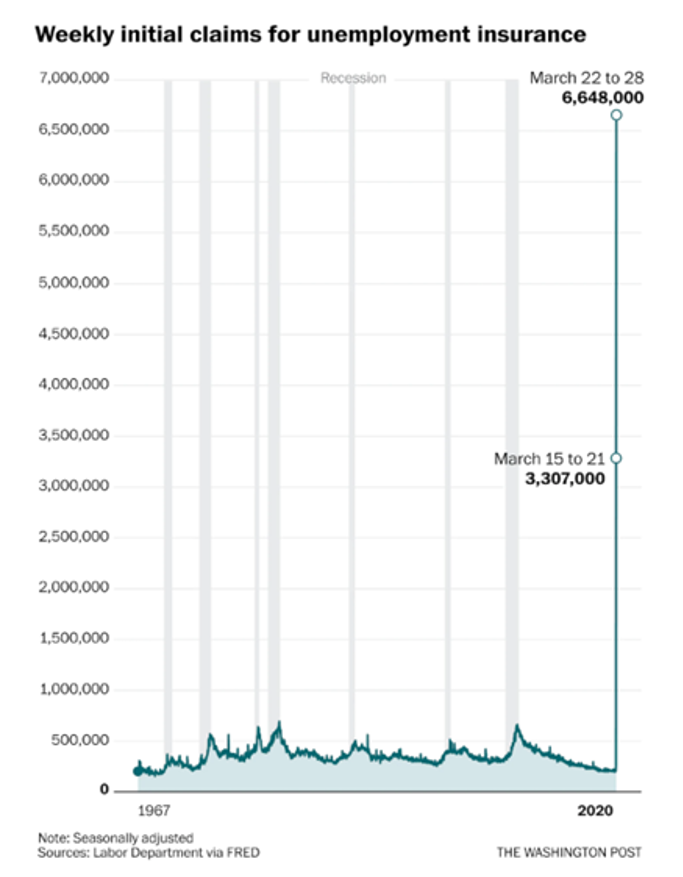

US Unemployment weekly applications:

Source: https://www.washingtonpost.com/business/2020/04/02/jobless-march-coronavirus/

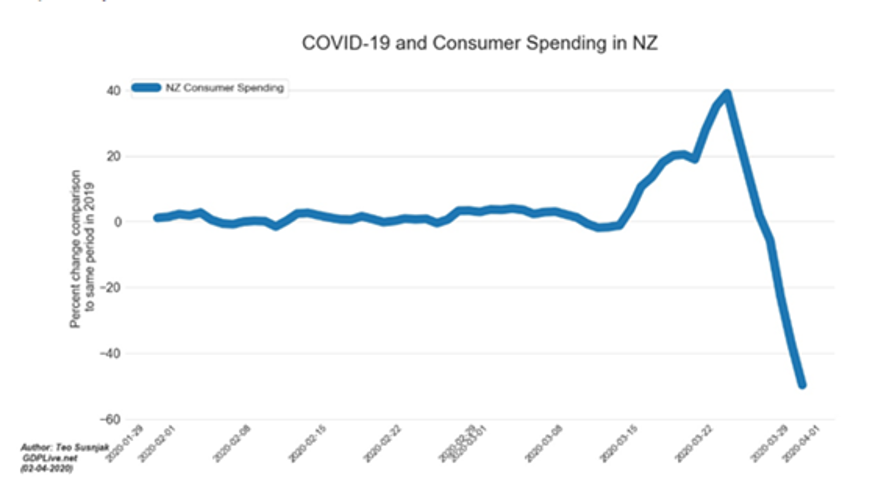

NZ Consumer Spending:

Source: https://github.com/teosusnjak/covid19NZ

So we have hit a very steep hill and our government (via the RBNZ and Treasury) are, or are about to, furiously put their foot to the floor in order to both increase government spending (fiscal policy) and ensure liquidity/credit remains available (monetary policy), with the aim of stopping the car from stalling.

3. The Role of Credit (read: Debt)

The oil of the economy is the availability of credit, because if folk/businesses haven’t saved their energy/money for the hill when the times were good, they need to borrow now.

In many western countries since the ‘Great Recession’ of 2008 (and earlier in Japan) the accelerator pedal has been more or less permanently ‘to the floor’.

The reality of this is a lot of borrowing, and a lot of public and private debt.

While I expect this will come back to haunt these countries in decades to come, in New Zealand we have been lucky enough not to have put the foot to the floor as much. Until now.

Personally, I believe the trick for us will be truthfully aligning people’s expectations right from the start about the pain that lies ahead, something that politicians and policymakers, particularly in the US, seemed to have struggled with since 2008, and certainly something I witnessed in Canterbury in the immediate aftermath of the earthquakes.

The alternative is the ridiculous promising of ‘unlimited stimulus’ that I have heard from other countries.

So, in the current environment, understanding the strength of the local private banking sector and the risks they take, is vital to ensuring we don’t end up in the same position as some other western countries who appear to be in for some very rough years ahead.

4. An example of the risks locally

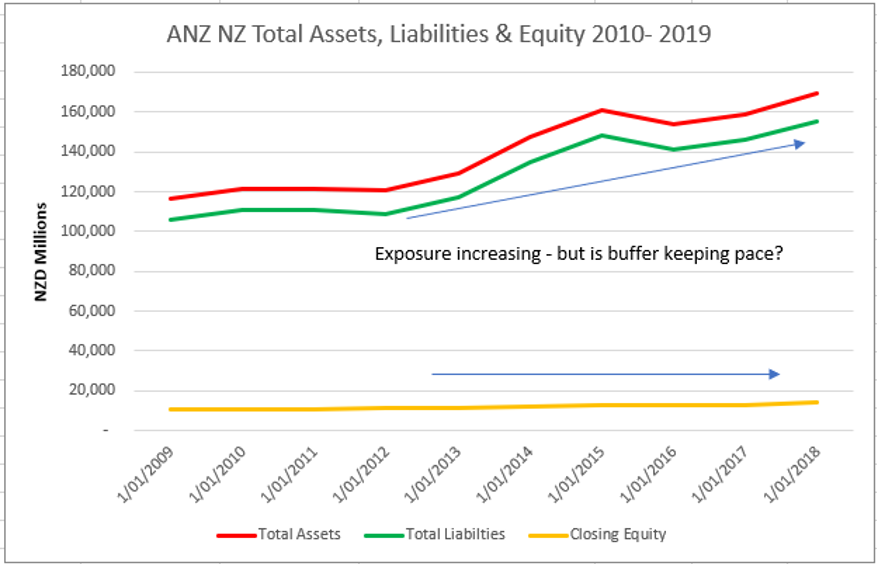

It helps to look at a simplified balance sheet of bank, in this example let’s look at ANZ, our biggest bank at present:

- Assets: (mortgages etc – money we owe the bank): $170 billion

- Liabilities: (deposit etc – money the bank owe us): $155 billion

- Equity: (the buffer) $14 billion

One of the roles of the RBNZ is to ensure that the ‘buffer’ that banks maintain is sufficient, so that when the car hits a hill, that the so called “Assets” of the banks – i.e. their loans to us, are actually going to be paid and that depositors funds are not at risk.

As you can see ANZ have $170 billion in assets, so if just 10% of these went bad ($17 billion) then there isn’t enough of a buffer of deposits and bank equity (retained profits) to cover it.

While the quality of loans and lending practices in NZ are supposed to be some of the best in the world, the amount of money that NZ banks (who are mostly owned by Aussie investors) hold as a buffer has been creating problems for regulators on both sides of the Tasman for quite some time now

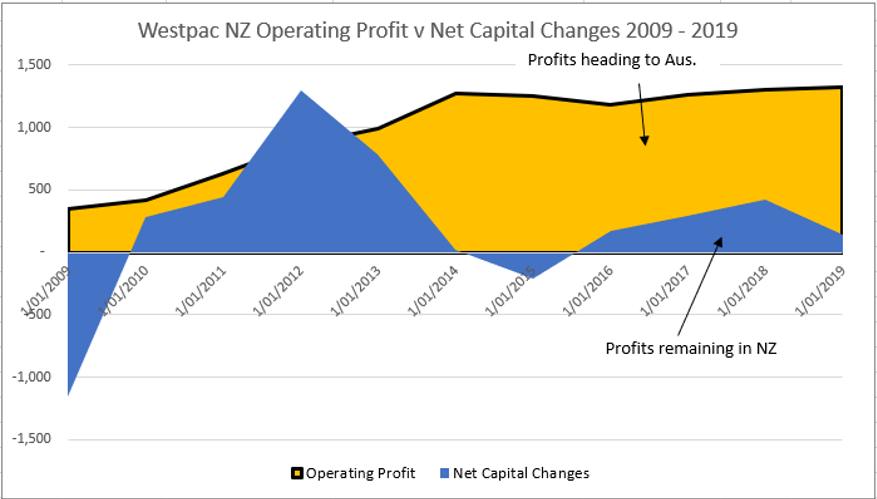

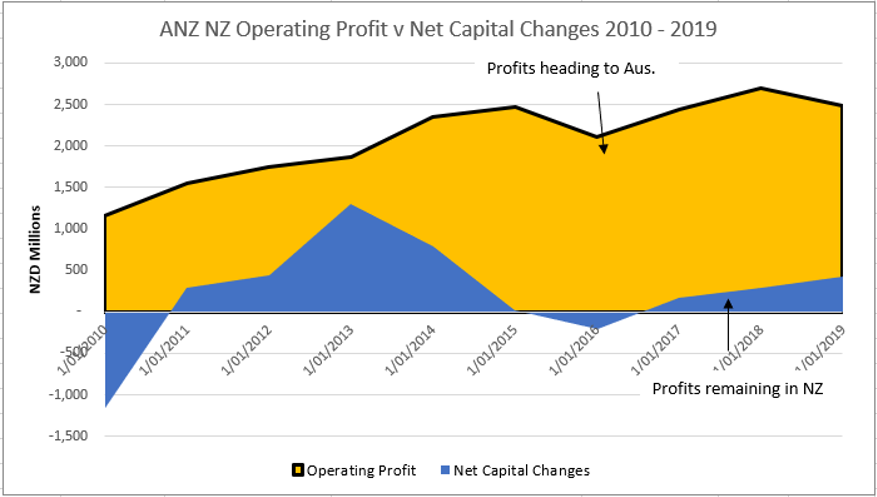

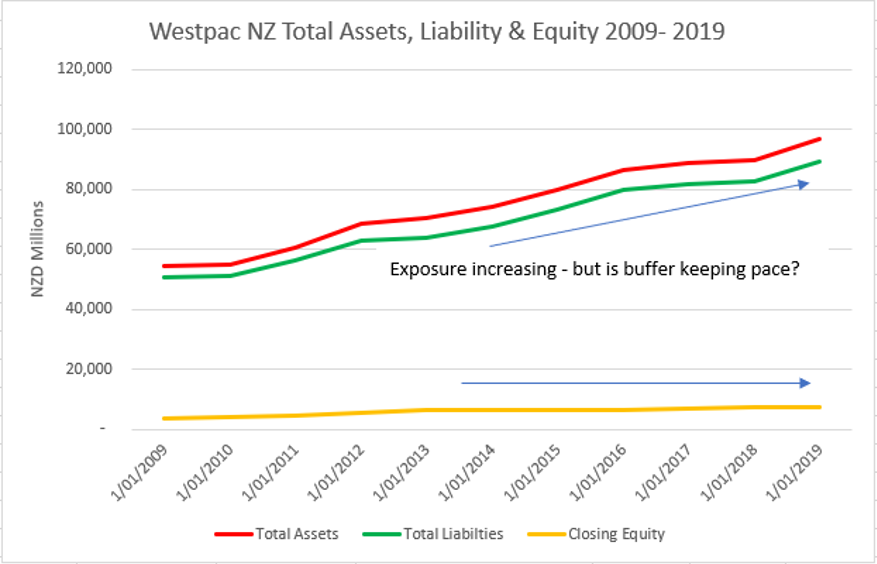

I’ve looked had a look at the data for ANZ and Westpac and created some graphs to illustrate the issue:

These two graphs show the extent to which the profits of ANZ and Westpac in NZ have increased dramatically since 2010 (the black line) but most alarmingly that the profits have been going back to Australia especially since 2015.

So, while the Aussie owned banks have been lending like mad and inflating the local housing market in order to increase their profits, the buffer, in case something goes wrong is really not moving much at all:

t’s not that the RBNZ haven’t been trying to do something about it recently, the Aussie regulator started making noises about the big Aussie parent banks’ exposure to international ‘contagion risk’ and the RBNZ started making noises about the amount of profit that was being extracted (in the form of dividends) from NZ banks by their Aussie parents. While changes are being slowly implemented, the RBNZ are running up against a public that struggles to understand the issue…

https://www.stuff.co.nz/business/118960217/the-great-bank-capital-scrap-noone-cared-about

…and very vested interests in the banking sector (of course you will know our ex PM is the Chair of ANZ), so I take my hat off to Adrian Orr who is trying his best to stand up to those interests, which is in our best interests.

Although they are making massive annual profits, I haven’t heard any of the banks talking about discounting interest rates to reduce their bottom line – just deferring interest – which could ultimately advantage them.

I won’t touch on their excessive executive remuneration as that has already been well discussed.

The reason I raise all this is because one of the big ‘accelerator pedal’ actions that our government this month has been to underwrite a further $6.25bln of business loans via private banks in New Zealand, and this could just be the start.

This means the banks will make all the profit from these new loans, however the government (us the taxpayer) is liable for all 80% of the loan value if they go bad.

On top of this is talk of relaxing the capital buffers further.

The banks are describing this as “necessary, appropriate and proportional” and that “”The Government cannot prevent a massive decline in economic activity, but it can limit the ongoing financial damage by preventing unnecessary insolvencies and debt defaults…These measures shouldn’t stress the Government’s balance sheet too much.” (Westpac chief economist Dominick Stephens).

I’m not sure that a bank that will make all the profit and bear none of the risks are independent enough to provide a balanced opinion on this.

5. No one has the solution

Anyway, Garry, I’m not saying that what has happened to date isn’t the right thing to do, right now. What I am saying is that overseas experience is that this can be the start of a rather slippery slope, and can end up with unintended long-term consequences.

The reality is this is all a very complex problem, but I encourage your readers to keep a close eye on it, try to understand it, but most of all keep a close eye on the ‘independent’ experts that profess to know the solutions.

They don’t know the right answer.

In my opinion the fiscal measures taken to date, such as the wage subsidy scheme, have made it to the right people; have been necessary, appropriate and proportional. However, my gut tells me that some of the monetary and fiscal policies available to get us over this hill aren’t sustainable in the long term.

It’s going to take a combination of actions, and one of them will be facing up to an unsustainable consumption/growth.

Let’s hope our politicians and policymakers don’t ‘kick the can’, as others have done, as in my experience the easiest route isn’t always the best one.

We need to be thinking decades ahead in deciding the path we take now.

However, in the fog of war and an election year – let’s hope some hard decisions get made.

In the meantime – stay safe, stay healthy, and keep an eye on those vested interests!

Cam

Leave a Reply