I am worried about some financial decisions being considered at CCC. Recently there was a proposal to reduce rates using subvention credits thus weakening the Council’s finances further.

In the Press Jake McClelland was reported as describing this proposal as:

“smoke and mirrors”, if there were no real savings to be had.

“It’s rates on Afterpay,” he said, referring to the buy now, pay later scheme.

To which Sam Macdonald replied to McClellan’s observation (his):

\ “basic level of financial illiteracy is incredibly concerning”.

“People are hurting out there … we should be doing all we can,” he said.

Challenging tax subvention payments was not “financial illiteracy”. It was fiscally responsible in my opinion.

Maybe Sam should have thought about people hurting when he supported expanding the size of the stadium currently under construction last year. Especially those in parts of the city who will never be able to afford to attend rugby matches, or concerts.

What is the Dilemma?

If the new proposal to accept subvention payments is passed the rates will be 11.74% in F25 year and 10.15% the year after. It just moves the problem out further. Only in F24 or the coming year will look good.

What are subvention payments?

The Inland Revenue identifies that “Subvention payments are payments by a profit company to a loss company. If the loss company agrees to receive a subvention payment, the profit company’s net income and the loss company’s net loss are reduced by the same amount.” (IRD website Transferring losses to another company).

For tax purposes Council is classified or grouped together with the CCHL companies in to one “Group”. This means that within the CCC and CCHL Group if some make a profit while other makes a loss, the loss can be offset against that profit. This reduces the tax liability of the Group.

CCC has budgeted this way for years, and if the process is done prudently, there is little, if any, risk. There will always be companies within the Group which make a profit. If CCC does not overcommit, it is a reliable means of reducing rates.

What is being proposed in this case is that an additional $7.5m is paid to CCC. Over and above what is used normally. The motive is to reduce the rate increase for the next year only.

As correctly stated by Councilors at the Council table, this is a one-off benefit. And in my opinion this is an overcommitment.

Let us consider a 10-year period and consider the impact.

It is proposed there is a $7.5m tax subvention payment received by CCC in next financial year. That’s it. It will have the effect of reducing rates in F24 by 1.5%. These additional subvention credits may not be available in the future at this level and at this stage CCC have not identified a reduction in expenditure.

CCC can only budget to receive $7.5m for one financial year under a tax subvention arrangement.

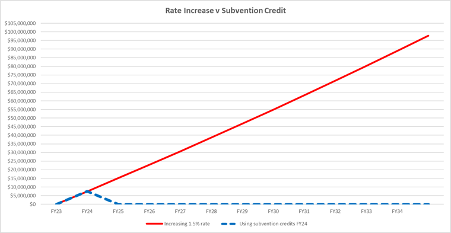

If the rates are increased, as they should be, then the graph below demonstrates that there is a $90m net improvement in income to the Council between the two options over a 10 year period.

We are only comparing taking a subvention payment or a rate increase of 1.5%, i.e., the difference between both options. Not the total rates proposed.

The graph shows the impact of either taking a tax subvention. Increasing the rates will earn CCC $97.8m in rates over 10 years and using subvention credit to reduce the rate impact by 1.5% will earn $7.5m for one year only. Then the Councillors will be faced with:

- a dramatic increase in rates

- having to lower the level of service (i.e., close libraries, mow parks less frequently, not fix potholes as frequently etc.). Or

- Sell capital assets within CCHL, which is what is desired by some around the Council table

To reiterate challenging tax subvention payments was not “financial illiteracy”. It was fiscally responsible.

Personally, I would put up the rates.

| FY23 | FY24 | FY25 | FY26 | FY27 | FY28 | FY29 | FY30 | FY31 | FY32 | FY33 | FY34 | FY35 | |

| Increasing 1.5% rate | $0 | $7,500,000 | $15,112,500 | $22,839,188 | $30,681,775 | $38,642,002 | $46,721,632 | $54,922,456 | $63,246,293 | $71,694,988 | $80,270,413 | $88,974,469 | $97,809,086 |

| Using subvention credits FY24 | $0 | $7,500,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

Personally, I would put up the rates.

Without claiming great financial literacy, I agree with Gary,s comment. Keep the city’s main assets and for god’s sake stop the Tarras airport scheme.

Hear Hear!