Because of my technical incompetence I have failed to produce a copy of my recent bill for my Zoom account to show you all.

However, here’s a copy of the account payment: Zoom.Us 888-799-9666 Www.Zoom.Us Ca $272.05US.

I wrote across the invoice I kept for my records “No GST – bastards”. I need the Zoom facility because I work from home and many of the organisations I am part of, or work for, use Zoom as a communication tool. It’s brilliant. However, these guys appear to not pay any tax in New Zealand.

I have searched on the internet how much tax Zoom pays in USA. The only thing I could find is 3 years old but this is what the article wrote at that time, saying that they paid $0 in US federal taxes despite making $663.9 Million in US pre-tax profits

But research and development credits accounted for just 1% of Zoom’s tax bill reductions, while around 99% of its savings were a result of paying executives $302.4 million in stock-based compensation, compared to $32.1 million the year before.

Zoom paid just $5.7 million total in taxes last year for an effective tax rate of 0.8%. But $3.9 million of that was paid on the company’s $14.1 million in foreign profits, for an effective rate of around 28%, highlighting major discrepancies in how the US tax system treats corporations.

Zoom’s (legal) use of stock payments to executives to reduce its tax bill reignited criticism from lawmakers and advocates who argue in favor of closing loopholes that allow massive, profitable corporations to pay less in taxes than millions of Americans.

“If you paid $14.99 a month for a Zoom Pro membership, you paid more to Zoom than it paid in federal income taxes even as it made $660 million in profits last year – a 4,000 percent increase since 2019. Yes. It’s time to end a rigged tax code that benefits the wealthy & powerful,” Sen. Bernie Sanders tweeted Sunday.

“Companies that compensate their leadership with stock options can write off, for tax purposes, huge expenses that far exceed their actual cost,” Matthew Gardner, a senior fellow at the Institute for Taxation and Economic Policy, wrote in a post breaking down Zoom’s tax strategy.

“This is a strategy that has been leveraged effectively by virtually every tech giant in the last decade, from Apple to Facebook to Microsoft. Zoom’s success in using stock options to avoid taxes is neither surprising nor (currently) illegal,” Gardner said, adding that along with its use of accelerated depreciation and R&D credits, is the same “recipe that Amazon and Netflix have used with such success to reduce their federal tax bills during the Trump corporate tax era so far.”

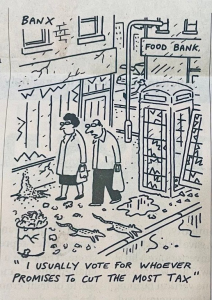

As we consider what these overseas monsters who supply us with the services we all rely on, including Zoom, maybe the Government, the Ministers of Finance and Revenue in particular, could think about these organisations starting to pay tax. They are sucking the life blood out of our economy. Look at the impact they are having on our media, with 20% of the journalists in our country being laid off soon. Where has the income from advertising which would enable the journalists to keep their jobs gone? USA. How much tax do these monsters pay? As little as is possible in some front country which lures them there with low tax regimes.

What would happen if Nicola Willis recommended to Cabinet that they should tax these companies? She would get slaughtered by heavy lawyers, from within NZ and around the world. Who wins in this case? Lawyers, firstly, and the companies secondly. Who pays? Kiwis who are losing their jobs because we all use, and need, these companies destroying economies throughout the world. Should we let them? NO.

If you want to hear the message from a successful Seattle businessman about how dreadful the state we are in listen to this, ironically on one of the websites I am critical of: https://podcasts.apple.com/nz/podcast/the-david-mcwilliams-podcast/id1462649946?i=1000651691023.

This guy talks about “pitchfork economics”. He says if things carry on the way they are with a 1% getting more and more of the international pie out will come the pitchforks and the mob (us) will turn on them.

Will the Government tax these companies? Nah. It’s easier to lay off staff or lower beneficiaries payments than it is to identify who are ripping all of us off in this country and dealing with them.

Postscript from Rosemary: I pay for several WordPress plugins, and was informed this week that the top Spam detector Akismet will now be accounting for GST. (5 Million installations) so some slow movement it seems. Apple icloud does not account for it yet.

Leave a Reply